blue chips for collectors and investors

Art investment

That’s why you should invest in art!

Works of art can greatly increase in value over time. This is partly due to the

limited availability of artworks and partly due to the increasing demand

for art from all parts of the world.

Over the decades, no other commodity has been able to increase capital as sustainably as art.

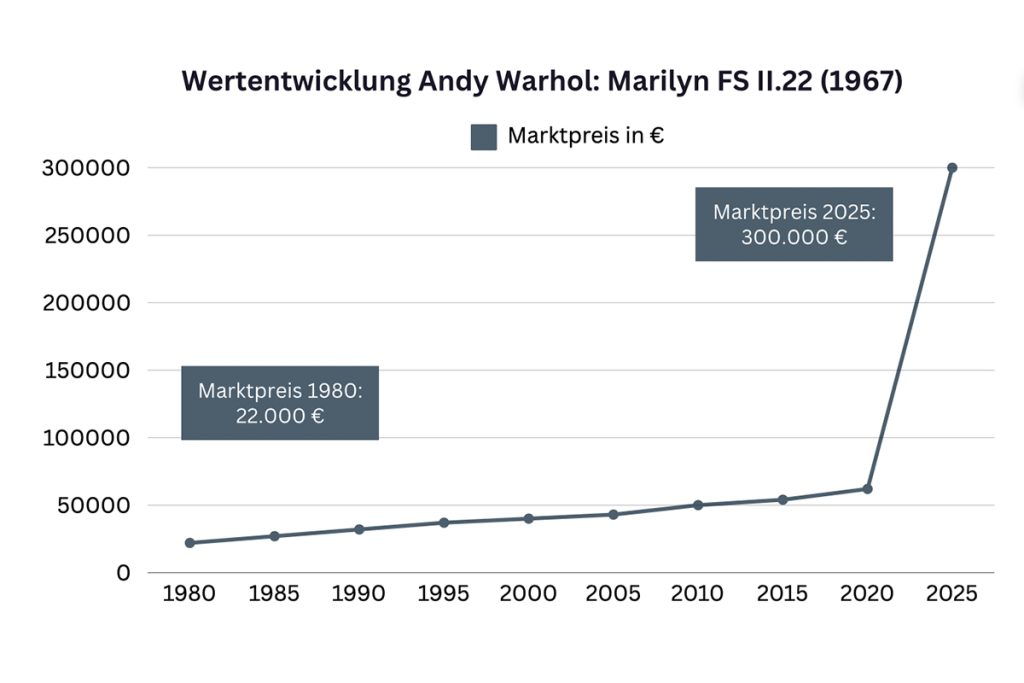

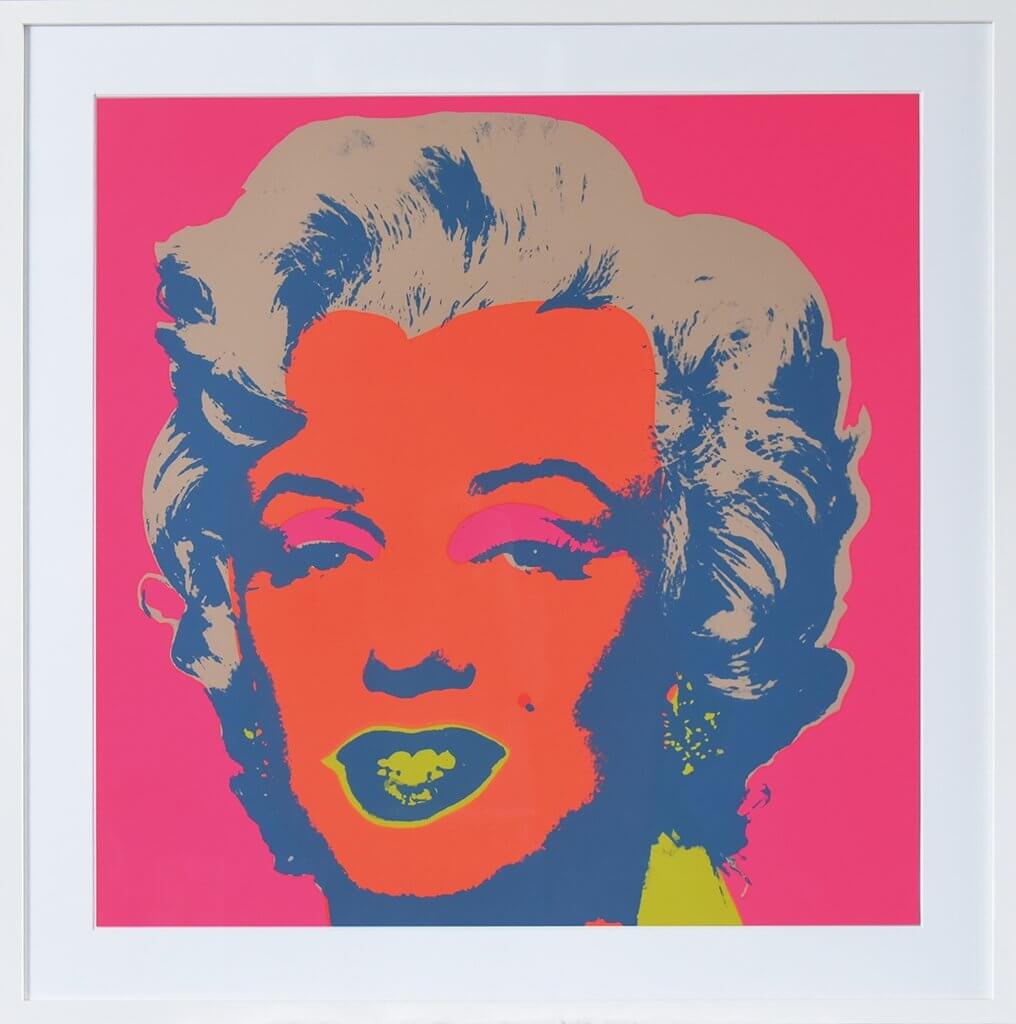

Art is a market with a stable value and a crisis-proof currency: a work of art does not wear out, it can be released and resold. As the age or fame of the artist increases, there is a shortage of supply, i.e. of originals, and the artwork increases in value. This increase in value always occurs, but can vary – some art values have multiplied in value, others have experienced an increase of 20 to 50 percent. The increase in value of Andy Warhol’s most popular print “Marilyn Monroe” from 1967 is one of the many successful examples.

Art as an Investment: A Deeper Perspective

In the latest editorial on ArtNet, I share valuable insights into the most common reasons people invest in art and emphasize the crucial role of a qualified advisor in navigating the art market.

Art investment in practice:

Two options

Art in the private home

The artwork comes to your home. The painting hangs on your wall and you can enjoy it every day and look at your investment (= emotional return).

Art in the art depot

For the duration of the investment, your artwork remains in a highly secure and fully air-conditioned art storage facility, which is under video surveillance around the clock.

Curious to find out more?

Get in touch!

Thoughts on the art of making money

What is Art Investment?

More and more private individuals and companies are securing parts of their assets with art as a tangible asset.

So-called blue-chip art offers security and the chance of an above-average increase in value. Art also stands for an emotional return, inspiration and prestige as well as cultural values. An investment in art is therefore always also an investment in an attitude of mind and aesthetic enjoyment as well as in education and culture.

The following people and companies invest in art, among others: Deutsche Bank AG, Commerzbank AG, Allianz AG, Brad Pitt, Elton John, Leonardo DiCaprio, Madonna, AXA Versicherung AG, Gunter Sachs, Edouard Carmignac, Deutsche Telekom AG, Jack Nicholson and Beyoncé Knowles.

Lecture “Art Investment” (ENG)

Lecture “Art Investment” (FRA)

Stabilization through diversification

Art investments help to diversify and stabilize your portfolio as they have a low correlation to equities and bonds. This allows you to spread risks better and benefit from a resilient art market.

Crisis resistance and security

Artworks are independent tangible assets that offer a high degree of resilience to capital market fluctuations. They also serve as protection against inflation, as their value often rises in line with the rate of inflation.

Long-term increase in value

Art is a globally tradable “currency” that constantly increases capital in the long term. Over the decades, no other form of investment has increased in value as sustainably as art.

Facts & Figures

Source: “Art & Finance Report”, Deloitte, 2019

84 %

of all European asset managers say that their clients want to invest in art (2017: 69%).

77 %

of European asset managers actively offer clients investments in art (64% in 2017).

76 %

of art investors value art investments for the simple and secure transfer of wealth to the next generation.

Voices about Art Investment

Art surpasses cars and watches as the fastest growing luxury good, with the value of art increasing by an average of 29% in 2022, outpacing global inflation as well as equities and gold.

The Times, 2023

Art is money on your wall!

Andy Warhol

In the last 20 years, sales of contemporary art have risen by 300% p.a.

UBS Art Market Report 2023

One of the greatest preservers of value is art!

Larry Fink, CEO BlackRock

The market for international contemporary art has been developing very positively for 55 years, with a performance of 10.95% p.a.

Deloitte Art & Finance Report 2023

If you are looking for something durable, it is better to invest in art.

Alan Greenspan, EX CEO US Federal Reserve

Examples of successful art transactions in the past

The art market has repeatedly impressed with remarkable increases in value, as

works by established artists have repeatedly proven to be stable and lucrative investments.

Keith Haring

A poetic extravaganza – Luna Luna

2015: purchased from Andre Heller for EUR 30,000

2018: sold to private collector for EUR 60,000

2019: auctioned at Christies for GBP 93,750

2024: USD 300,000 – 350,000 Market value

Andy Warhol

Marilyn FS II.22

2000: market price of EUR 55,000

2012: sold for EUR 145,000

2024: market price of EUR 350,000

Roy Lichtenstein

Forms in Space

2000: market price of EUR 11,000

2013: auction result of EUR 36,000

2020: sold at Sotheby’s for USD 214,200

(estimate: USD 50,000 – 70,000)

What are you waiting for?

When you invest in a work of art with LESKOVARFINEART, you are also investing in insider knowledge and more profit.

Give me a call